Income tax notices are official communications from the government concerning tax-related matters. These notices are essential means through which the government informs taxpayers about discrepancies, requests for information, or changes in their tax status.

Understanding and promptly responding to income tax notices is crucial. It ensures compliance with tax regulations, prevents legal implications, and secures financial stability.

Table of Contents

ToggleTypes of Income Tax Notices

Non-Disclosure of Income

- Income Tax Notice: Issued for undisclosed income in the tax return

- How to Reply Income Tax Notice: Respond by explaining and providing documentation of reported income sources

Rectify errors, pay applicable taxes and penalties

Delay in Filing ITR

Sent for failing to file tax returns on time

Respond by acknowledging the delay, providing reasons, and filing pending returns

Income Tax Demand Notice: Pay any applicable fines or interest

Tax Evasion

Issued for intentional evasion or underreporting of income

How to Reply Income Tax Notice: Reply with detailed explanation, rectify inaccuracies, pay owed taxes and penalties

Income Tax Demand Notice

Notice of Demand: Sent for pending tax liabilities

Respond by understanding, validating, and paying the outstanding amount or challenging it legally.

Setting off Refunds Against Tax Payable

Adjusts pending refunds against tax liabilities

Reply by scrutinizing adjustments, providing clarifications, and settling remaining tax liabilities

Understanding how to respond to these different types of income tax notices, including income tax demand notices, is essential to maintain compliance and effectively resolve discrepancies.

Key Components of Income Tax Notices

The Contents of Income Tax Notice

- Income Tax Notice: Every notice from the income tax department contains vital information regarding tax-related issues.

- Government Notice: These notices outline specific regulations or changes relevant to tax compliance.

Interpreting Government Notices for Tax Compliance

- Income Tax Demand Notice: Essential notices specify the amount due according to the income tax department.

- Income Tax Department Notice: Official correspondence from the tax department regarding various tax matters.

Time Limits and Repercussions for Non-Compliance

Income Tax Notice Time Limit: Notices often stipulate a specific duration for response or action.

The time limit for responding to an income tax notice issued under section 147 is three months from the end of the month in which the notice is given. The Assessing Officer can extend this period.

For a reply in response to a show cause notice, the duration is between 7 to 30 days from the date of notice issuance.

Non-compliance might lead to penalties, legal consequences, or further actions by the tax authorities.

Understanding the contents of these notices, interpreting government notices for tax compliance, and adhering to time limits outlined in income tax notices are critical to avoid repercussions and ensure compliance with tax regulations.

How to Respond to Income Tax Notices

Format of Reply - Guidelines and Best Practice

Adhering to Legal Norms: Ensuring your response complies with regulatory standards.

Tailoring Your Reply: Personalizing the response while maintaining professionalism.

Addressing Notice Errors or Discrepancies

Identifying Discrepancies: Steps to detect and comprehend the issues outlined in the notice.

Corrective Measures: Strategies to rectify errors effectively and efficiently.

Professional Language: Crafting a polite and concise response to address these issues.

Providing Necessary Documentation and Information.

Organizing Documentation: Tips on categorizing and arranging documents for a clear submission.

Clarity in Information: Emphasizing the importance of accuracy and completeness in the provided data.

Supplementing with Explanatory Notes: When and how to include additional clarifications or notes.

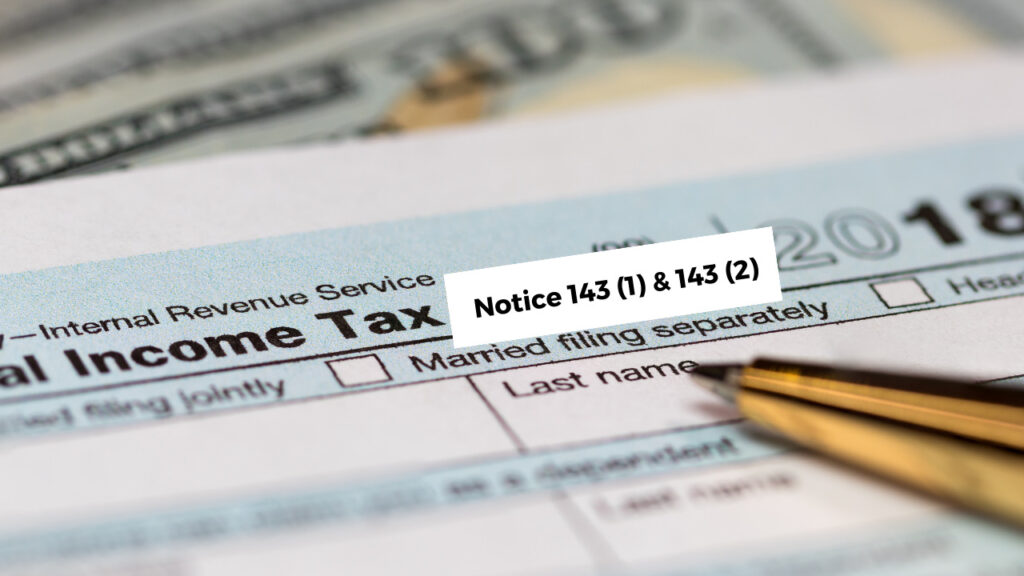

Income Tax Notice 143 1 & Notice under Section 143 2

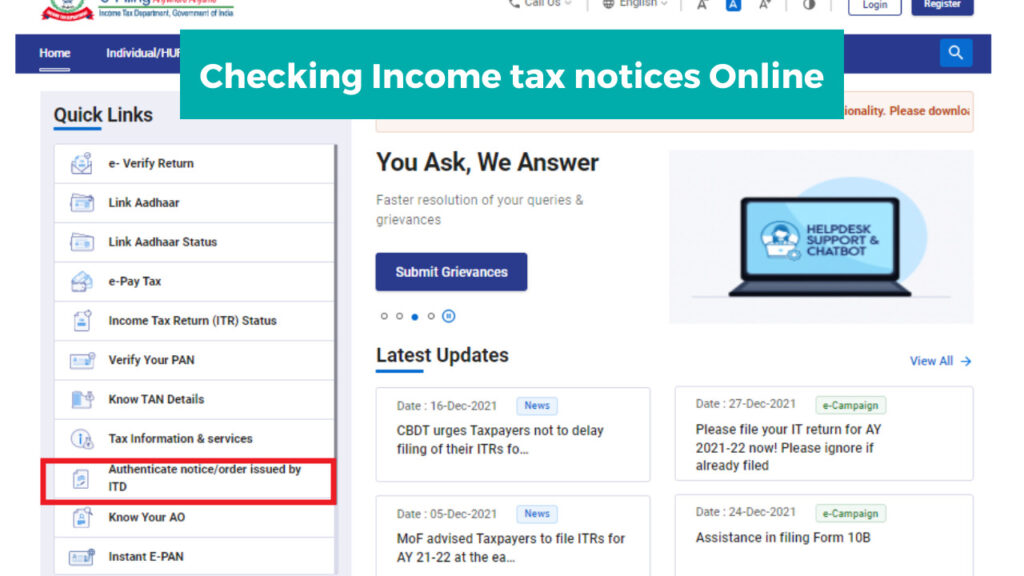

How to Check for Income Tax Notices Online

Utilize the Income Tax Department Portal: Log in to the official website of the Income Tax Department.

- Access Your Account: Use your credentials to enter your account dashboard.

Check Notifications or Alerts: Look for specific sections indicating notifications or alerts for any income tax notices.

Regular Monitoring: Make it a habit to check your account for any updates or notifications periodically.

Strategies to Avoid Receiving Notices

- Timely Filing of Returns: Ensure your income tax returns are filed on time to minimize the chances of receiving notices.

- Accurate Information Submission: Double-check all information before submission to prevent errors.

- Compliance with Regulations: Abide by all tax regulations and laws to avoid discrepancies.

- Seeking Expert Consultation: When in doubt, consult tax professionals for accurate filing.

Seeking Professional Assistance and Guidance

- Tax Consultants or Advisors: Engage with qualified tax professionals who can provide guidance and assistance.

- Understanding Notices: Seek professional guidance to interpret and understand the implications of any received notices.

- Resolving Issues: If faced with complex notices, professional help can aid in effectively addressing them.

Conclusion

Handling government notices, especially income tax notices, is vital for financial compliance. Timely, informed responses are crucial. By empowering individuals with knowledge and prompt action, better tax compliance is achieved, ensuring smoother dealings with income tax notices.