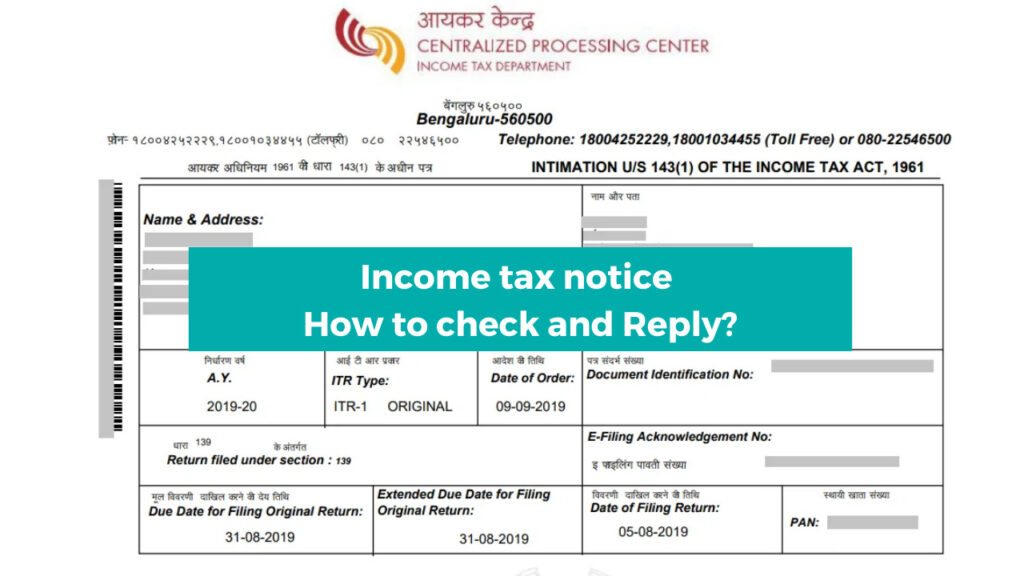

Income Tax Notice – How to Check & Reply?

Income tax notices are official communications from the government concerning tax-related matters. These notices are essential means through which the government informs taxpayers about discrepancies, requests for information, or changes in their tax status. Understanding and promptly responding to income tax notices is crucial. It ensures compliance with tax regulations, prevents legal implications, and secures […]

Transfer Pricing case and Turnover Criteria: Recent Case Analysis

The case of Infor (India) (P.) Ltd. dealt with significant aspects of turnover as a criteria in selecting comparables in Transfer Pricing cases and the application of a tolerance range. Additionally, it addressed the issue of determining the Arm’s Length Price (ALP) concerning management fees paid to an associated enterprise (AE). Background Infor (India) (P.) […]

Impactful Ruling on Interest Income | NHIDCL Case

The case of the Deputy Commissioner of Income-tax, Circle 16(1) versus National Highways & Infrastructure Development Corp India highlights an important ruling by the ITAT, Delhi. The dispute revolves around the treatment of interest income earned by the National Highways Infrastructure Development Corporation (NHIDCL) and the implications of the same on the company’s tax liability. […]

Income Tax Notice Violation: Gujarat High Court Ruling

The case of Rajeshkumar Arjanbhai Vekariya v. Deputy Commissioner of Income-tax centered on the issuance of an order under Section 179 of the Income-tax Act, 1961, for the recovery of tax dues from the petitioner, Rajeshkumar Arjanbhai Vekariya. The central argument revolved around the claim that the order was passed without the due service of […]